In Australia, the criteria and grants for First Home Buyers vary between each State. Along with getting to know which ones apply to you, also aim to improve your general property knowledge and financial habits.

The Family Property Guide

How to use Family Collaboration to Purchase Property.

Our Family Property Guide is an online tool that allows families to understand the options available in purchasing property together. This may be for first home buyers or parents supporting their children in entering the property market. There are many components to the property journey, including the search, making choices and comparisons, finding finance, asset protection and other general dealings of property.

Please complete and submit the checklist provided below as a launch pad for further support.

Make Informed Decisions

The general information in our Family Property Guide may be helpful for you when making decisions with your finance broker, accountant, lawyer and other property advisers.

The guide aims to raise awareness of the factors relevant to your circumstances, including:

- Assisting First Home Buyers

- Understanding the Grants & Schemes that are available

- Options for family to provide financial support, including guarantees

- Broader finance & mortgage considerations

- Property planning & legal aspects

- Negotiating considerations and pathways.

Disclaimer

The information in this Guide is general information only. It is not intended to be a recommendation or constitute advice. We strongly recommend you seek the appropriate advice as to whether this information is appropriate to your needs. Whilst every care has been taken in the preparation of this Guide, the author and associated entities, its directors, or consultants expressly disclaim all and any form of liability to any person in respect of this Guide. This includes any consequences arising from its use by any person in reliance upon the whole or any part of this Guide.

FIRST HOME BUYERS

1. GETTING STARTED

Research

Read, Listen, Watch: Research and extend beyond what you already know. There are many good property trend blogs, podcasts and books available to assist your property education journey.

Build your Financial Base

Beyond earning and spending, apply strategies like “paying yourself first” and allocate say 10% or more of your after-tax income to savings and investments. Look at where can you trim consumer spending habits and redirect these funds to savings.

Avoid “click bait” Headlines

As in… will prices crash, will interest rates go down, where are the latest hot spots – most times this is speculation and distraction. Instead, remove emotional triggers by doing quality research.

Be Finance Ready

Understand your credit score. Your credit score in Australia typically ranges from 0 to 1,000. From a lender’s perspective, the higher the score, the more financially trustworthy a person is found to be.

Start now to pay down any ATO and consumer debt, review HECS debt and reduce credit card limits. Look to consolidate credit cards and personal loans to manage interest/repayments.

Managing Emotions

Be prepared for a competitive market, possible setbacks, and the emotional ups and downs of the property process.

2. GOVERNMENT SCHEMES & GRANTS

First home buyers in Australia can access to a range of grants, concessions, and government-backed schemes designed to support them entering the property market.

As a rule, you must be over 18, an Australian citizen or resident and purchasing to personally occupy the property for at least a 12-month period. The incentives are broader for new as opposed to existing property.

State Government Incentives:

First Home-Owner Grant (“FHOG”) $10,000 - $15,000

A one-off payment is available for eligible first home buyers purchasing or building a new home. (Generally, up to a limit in most states).

Stamp Duty Exemption and Concession

Full exemption: No stamp duty is payable on first homes valued at $600,000 in Victoria for example, with concessions out to $750,000. In NSW, it is up to $800,000 and in South Australia, there is no limit. This is a substantial saving and applies to both new and established homes.

Australian Government Incentives:

Home Guarantee Scheme (HGS)

HGS support three types of eligible home buyers:

First Home Guarantee (FHBG): The government guarantees up to 15% of the property’s value, so buyers avoid paying LMI with only a 5% deposit required.

Regional First Home Buyer Guarantee (RFHBG): terms are as above though be mindful you may need to have lived regionally for a period beforehand.

Family Home Guarantee (FHG): eligible single parents/guardians can buy their first home or re-enter the market for a 2% deposit.

Property price and income caps apply, that vary by state and region (e.g. $900,000 in Sydney, $800,000 in Melbourne).

Help to Buy Scheme

The Help to Buy Scheme assists eligible buyers in purchasing a home with a deposit as low as 2%. The Government contributes up to 40% of the price for new homes and 30% for existing homes, for holding an ownership in the property. When the property is sold, the government recoups its share plus any capital gains.

Criteria, Benefits & Scope:

• Income Caps: $100,000 for individuals, $160,000 for joint applicants or single parents

• Reduces the Loan amount to provide a serviceable mortgage

• 10,000 places per year (FY2024-25), 40,000 total places over four years

As an example, for a $600,000 property purchase:

• Purchaser pays a $12,000 deposit

• Government contributes $240,000

• Purchaser borrows the remaining amount

First Home Super Saver (FHSS)

FHSS helps first home buyers save for a house deposit using their superannuation fund. You can contribute up to $15,000 per financial year, with a total maximum of $50,000.

You can withdraw these extra contributions to use as a deposit. Withdrawals are taxed at your marginal tax rate, minus a 30% offset for concessional contributions. Ensure you get further advice on this one.

GETTING FINANCE READY

1. HOW TO PREPARE

There are several important stages and preparations that individuals and families can do to assist in being “Credit Ready”.

Preparation is vital and you and your family may need to make changes to your current financial position before you are ready to go. For example, can you set and maintain a budget to reduce existing debt and build savings for a deposit? Are you able to ensure the stability of ongoing income?

Keep your larger financial picture in mind beyond how much I can borrow? Terms like Debt-to-Income Ratio and Serviceability are important to know.

Build an understanding of how mortgages work and what lenders are looking for - often referred to as the “Cs of Credit” as follows:

Character – reflected in your previous credit conduct.

Capital – the savings contributed as a deposit.

Capacity – no matter the size of deposit, you need sustainable income to meet new loan repayments. Be aware that lenders add an interest rate buffer of 2-3% when assessing capacity, which will impact results.

Collateral – the property type you are purchasing must be an acceptable type, size and location to meet a lender's criteria.

All this with drive the Conditions (terms and other details) of the credit you are able to obtain.

2. FINANCE PRE-APPROVAL

If you seek pre-approval for finance, then follow these steps.

1. Review Your Current Financial Status

Credit providers use "scores" to assess your reliability in repaying debt. Your credit score can range from 0 to 1,200. The higher the score, the more trustworthy a person is seen from a credit perspective.

The score is driven by many factors (your previous conduct, frequency of application, etc.) and also by demographic factors such as age and where you live.

2. Organise your Documents:

Identification: Passport, Driver Licence or alternatives. (Make sure they are current).

Income: Recent payslips, Tax Returns & Financials, Bank Statements.

Capital: Savings, investments, property, credit cards, loans, other debts.

Expenses: Document your ongoing costs, including non-discretionary and discretionary costs.

3. Choose a Credit Provider

Not all lenders offer a Pre-Approval service. Be aware that many are indicative rather than “Credit Sanctioned”.

4. Submit a Pre-Approval Application

You will need to complete an application and provide the required documents. The application should outline your property price range and available deposit amount to support your intended budget.

5. Assessment

The Credit Provider will verify your documents, conduct a credit check and assess the application as presented. Borrowing capacity will be evaluated as part of your overall situation.

6. Conditional Pre-Approval

If you meet the criteria, you will receive a document outlining the maximum amount you can borrow and any conditions. This is typically valid for around three (3) months, can vary by lender and may need to be updated if your circumstances change.

7. The Property Search

You will now have more confidence to look for properties that are within your budget. Once you find a property, you'll need to move to unconditional approval, which may require additional processes including a property valuation.

Other Considerations

Final loan approval is subject to conditions such as property suitability, Credit Provider policy changes, interest rate settings and of course no broad changes to the financial situation that was presented originally.

LOAN FEATURES

1. COMPONENTS

Getting a Mortgage(s) is not an exact science. In the most basic sense, money is a commodity and the product offerings between credit providers are increasingly similar.

Reputable finance brokers will always strive for good customer outcomes and will be aware of key laws (such as Conflicted Remuneration and Best Interest Duty) that provide the necessary regulatory framework to support and protect borrowers.

The interest rate received at the start of your loan is important of course. However, in our experience, the structure and subsequent conduct of borrowings is normally more important than the credit provider selected and the subsequent interest rates.

Therefore, form a plan for how you might structure and conduct your mortgage(s) in the longer term.

Think about how you will use product features such as redraw and offset.

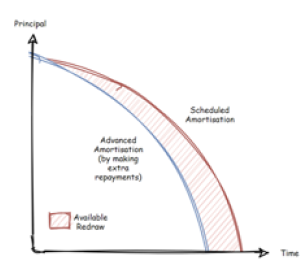

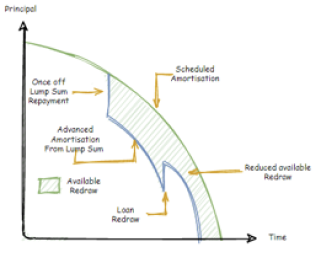

REDRAW FACILITY

A redraw facility gives you access to funds you have prepaid in advance of the minimum scheduled repayments.

Typically, redraw is unlimited and fee free for variable rate loans. Redraw is usually limited or unavailable for fixed rate mortgages.

You will usually see your available redraw amount in your online banking. Your available redraw and your loan balance will form your loan limit.

It is important to consider redrawing money as effectively “reborrowing” repaid money.

Every time you use redraw you are prolonging the life of the loan.

OFFSET ACCOUNTS

Mortgage offset accounts were first offered to manage tax but extended to other mortgage products that were “packaged” with an offset capability.

Offset accounts offer the ability to isolate your savings from your loan, but whether it really works for you depends on your circumstances.

An offset account is linked to a loan, and the credit provider calculates the daily interest on the net balance (the loan balance less the offset balance).

For future investors (i.e. if you are planning to convert a first home into a hold & rent out scenario) an offset account may be a vehicle where you can build up cash reserves to use to contribute to a new purchase (non-deductable debt) and leave the "old debt" against the now investment mortgage.

Do you need an offset account? You should seek tax / financial advice if you are unsure.

2. GETTING AHEAD

Nowadays there are many books and resources that offer methods to pay off a mortgage sooner.

Strategies that can help, include:

- Making fortnightly or weekly loan repayments, as opposed to monthly loan repayments.

- Using an offset account facility as outlined above.

- Creating a separate loan split and establish a goal for paying it off within a certain period.

- Obtaining a P&I loan for a shorter term than 30 years, forcing a routine of additional repayments.

While all of the strategies recommended are valid, the key is finding the methods that work for you and your specific circumstances.

3. INTEREST RATES

Interest rates vary depending on the type of loan you seek (i.e. fixed or variable interest rate).

Interest rates are also driven by:

- The basis of Repayments (Interest Only - IO or Principal & Interest - P&I)

- The Loan to Value Ratio (LVR)

- The Purpose of the Loan (Investment or Owner Occupied)

- The Size of your lending

We have included an indicative chart below for these:

| Owner Occupied P&I | Owner Occupied IO | Investment P&I | Investment IO |

|---|---|---|---|

| Lowest | High | High | Highest |

These rankings are fluid and can change over time. Interest rate settings are not just determined by credit providers, but also regulators, whose policy settings can dictate the supply of different loan types.

Lastly, mortgage credit providers either offer a set or "carded" interest rate, or your broker may talk about "pricing" a loan. This is where an ongoing discount is provided on a benchmark or standard interest rate.

Making use of a Loan Repayment Calculator will help you to test a variety of scenarios.

HELP FROM FAMILY

How to use Security Guarantees to support family in purchasing property.

1. SECURITY GUARANTEES

Family members can provide "security" or "collateral" generally in the form of a residential property. Typically called a Family Security Guarantee, or similar, it is distinct from an Income Guarantee, which supports the borrowers in making ongoing loan commitments. Under the arrangement, a family member serves as a guarantor for another. Commonly, the security or collateral required by a lender from a guarantor is a low mortgage or mortgage-free residential property.

Who can be a family member?

Anyone who passes the standard requirements can become a security guarantor for other family members. Looking beyond mum and dad, sometimes other family members such as grandparents and siblings may offer to provide guarantor support. Adult children may also be guarantors to their parents in some instances.

Using cash as security?

Some lenders allow for the security guarantee to be held against a cash term deposit. The term deposit is established and will continue to roll over until the required Loan-to-Value Ratio or LVR is achieved, usually 20%. A Family Security Guarantee cannot be used for debt consolidation, owner-builder construction, cash out, or adding a security guarantee to an existing loan.

Ways a family security guarantee can aid borrowers?

The first hurdle for first-home buyers or those looking to upsize to a second home is saving a sizeable deposit. Often, lenders require an additional loan mortgage insurance fee when deposits are below 20% of the loan value. The LVR is a percentage determined by dividing the loan amount by the property's value or purchase price. In practical terms, the bigger the deposit, the lower the LVR, therefore increasing the likelihood of a loan approval along with other terms, such as interest rates.

2. POTENTIAL BENEFITS

How a Security Guarantee works?

Consider two common ways a security guarantee is utilised between family members. Firstly, to save on Lender's Mortgage Insurance and reduce upfront costs. Secondly, to make it easier to buy a property that may be outside of the borrower's existing range.

a) Saving on Lenders' Mortgage Insurance (LMI)

In some circumstances, several lenders have recently waived the need for income details or statement of position information from the guarantor when the funds go towards removing LMI. Consider this scenario:

Sam and Jo have found an ideal home with a purchase price of $750,000. They have a deposit saved of $90,000 and have sufficient income to service the loan. However, the lender advises that since the LVR exceeds 80%, LMI will be required, as shown below:

|

EXAMPLE PROPERTY PURCHASE: |

$AMOUNT |

|

Purchase Price |

$750,000 |

|

Cash Deposit |

$90,000 |

|

Additional "Security" Value |

n/a |

|

Initial Loan Amount |

$660,000 |

|

Loan to Value Ratio (LVR) |

88.0% |

|

Indicative LMI Premium^ |

$17,000 |

|

Stamp Duty |

$31,070 |

|

Legal Costs |

$1,500 |

|

Other Upfront Costs |

$49,570 |

^LMI is typically financed over the loan term.

After receiving the independent advice, Sam's parents provide a Security Guarantee of $97,500 against their mortgage-free home to boost the deposit contribution. The LVR is lowered below 80% and removes the need for LMI as below:

|

ADJUSTED POSITION |

$AMOUNT |

|

Purchase Price |

$750,000 |

|

Cash Deposit |

$90,000 |

|

Additional "Security" Value |

$97,500 |

|

Initial Loan Amount |

$660,000 |

|

Loan to Value Ratio (LVR) |

77.9% |

|

Indicative LMI Premium^ |

$0 |

|

Stamp Duty |

$31,070 |

|

Legal Costs |

$1,500 |

|

Other Upfront Costs |

$32,570 |

Sam & Jo proceed to purchase the property. Once the loan amount is reduced to an LVR of 80% or below, the guarantee against Sam's parents' home can be released.

b) Boosting equity contribution to purchase the next home

A security guarantee can help family members buy a home by increasing the size of the deposit available to use to obtain a loan. In most cases, a single guarantee can represent no more than 50% of the loan guarantor's security.

Updated Scenario - Sam & Jo

Eight years later, Sam and Jo decide to buy a much larger home in a high-demand suburb. The previous guarantee with Sam's parents has been released on their existing property. After selling their home, Sam and Jo have savings of $250,000 to use for a deposit (allowing additional funds for stamp duty and legal fees).

Jo's older sister Holly offers to provide a security guarantee to boost their deposit to 20% for their next property. Holly's property is valued at $800,000. However, she already has a mortgage of $250,000 and can only leverage up to 50% of her property as a guarantor. Sam & Jo's mortgage broker secures a guarantee of up to $202,500, which gives them a possible deposit of $452,500.

The pair find the ideal property for $2.2 million which requires a deposit of $440,000. Sam and Jo use $250,000 of their deposit funds and a security guarantee against Holly's property of $190,000.

3. FAMILY LOANS OR GIFTS

Family support by way of a gift or a loan can be another way to help family enter the property market. However, it generally requires good planning and proper documentation to avoid any unintended financial or legal consequences. They have potentially different applications.

a) Family Gift

Overview

A lump sum given to the child with no expectation of repayment, typically used for the deposit or to reduce the size of the mortgage.

Documentation

A gift letter or statutory declaration is required to confirm the money is a genuine gift, avoiding any future issues.

Lender Requirements

There are some lenders that accept gifts of money as genuine savings, allowing the recipient to access more capital and purchasing power.

Statutory Considerations

Gifts are generally not treated as taxable income, but the givers should consider their own financial situation to avoid affecting other entitlements.

b) Family Loan

Description

Loan to a family member with an expectation of repayment under agreed terms.

Loan Agreement

A written loan agreement is recommended that outlines:

- Repayment basis

- Interest rate to apply

- Security (Second property mortgage or caveat)

- Completion date (fixed term or on sale of the property)

Lender Requirements

Lenders will generally treat family loans as a liability, affecting the recipient's borrowing capacity.

Statutory Considerations

The loan can have tax consequences. Interest received may be taxable income for the giver.

Get Advice & Document Everything

Clear advice is critical, along with proper documentation that is drawn up while everyone is happy. Clear expectations from the outset reduce disputes arising about whether the funds were a loan or a gift. In addition, there is a clear path forward to handle funds in the case of relationship breakdowns or estate planning matters.

PROPERTY PLANNING

NEGOTIATING

In our view, successful negotiation is one of the keys to obtaining the best return on property investment. Guiding rules include:

1. Establish a fair market price

Based on a valuation and property inspection checklist.

2. Plan the negotiation

1. Establish a fair market price

Based on a valuation and property inspection checklist.

2. Plan the negotiation

- Maximum purchase price

- Minimum settlement time

- Special conditions such as building inspections, finance approval, development approval or subdivision approval.

3. Research the reason for selling

Ask your solicitor to search copies of the title for mortgage details. Several mortgages may indicate difficulties in servicing the loan. Speak to the agent, neighbours and the vendor directly if possible, to establish reasons for selling.

Curb your initial enthusiasm!

Identify and focus on the weaker aspects of the property. All properties have areas of improvement that can be brought to the attention of the vendor or his agent.

Research external factors:

- Possible interest rate increases

- Unemployment increases

- Changes in the market

- Closure of local and regional infrastructure

- Planned developments with negative impacts

- Possible school closures

Negotiating Strategy

Be prepared to walk away from negotiations if the best price and conditions are not met. This strategy may pressure the vendor to indicate the bottom price they are willing to accept.

Property investment should not be an emotional decision. Pre-planning and being well informed on price and local issues gives you the best possible chance of a successful negotiation.

LEGAL ASPECTS & CONVEYANCING

Conveyancing is the process of transferring the title of a property from one party to another. A typical conveyancing transaction contains milestones including the exchange of contracts (whereby equitable title passes) and the completion or settlement stage (whereby legal title passes).

A property purchaser must ensure that they obtain a good and marketable 'title' to the land and that the seller is the true owner.

The vendor's statement (or Section 32) sets out to a potential purchaser the details affecting the title, such as any mortgages, leases, caveats, easements, the zoning, rates and so forth. If the seller is aware of other matters that may have an impact on the value of the property, such as roadworks or acquisition for public housing, this must also be disclosed.

In Australia, this process is supported by a system of land registration to ensure purchasers of land are taking good title. Almost all conveyancing transactions in Australia now run through a digital platform known as PEXA (Property Exchange Australia) to which almost all Lawyers, Conveyancers, Lenders and relevant Government authorities are connected, including the State Revenue Office, Councils and water authorities.

You can learn more about PEXA at www.pexa.com.au.

PROPERTY TYPES

CHOOSING A PROPERTY

Residential property types include houses, apartments, townhouses, and units. Choosing a property type can be a complex decision. Having an open mind can be helpful. Take the time to do your research and avoid any unconscious bias clouding your thinking.

For example, the market for Units and Apartments can be a more affordable option for investors and owner-occupiers alike.

Of course, make sure you do your homework or get advice from trusted experts. Some factors to consider include property size, land size, location and density. Read this for more financing for unit tips.

Buying Off-the-plan

Buying a house or unit before the building works have been completed is known as buying off-the-plan. This includes property that is yet to be constructed or is partially constructed.

Stamp duty savings are only applicable to property being purchased as a principal place of residence. Other concessions apply to first home buyers.

Changes to the existing off-the-plan concession, may mean previously ineligible applicants qualify for a temporary concession for off-the-plan purchases of dwellings. For contracts entered into after 21 October 2024, purchasers can deduct the construction costs incurred on or after the contract date when determining the dutiable value of the property.

The temporary concession is available to all purchasers, including investors, companies and trusts, without the requirement to be eligible for either the principal place of residence duty concession or the first home buyer duty exemption or concession.

Speak to your MCP Finance Partner for guidance.

FAMILY PROPERTY & FINANCE ACRONYMS EXPLAINED

Below are some of the common words & acronyms you may hear in conversation or documents - it is good for all parties to have an understanding of what they mean.

Debt to Income ratio. This is a test which is a ratio of your household gross income to debt. A DTI ratio above 6 is usually where lenders start being cautious, and approval is less predictable.

Person(s) that have promised or ‘guaranteed’ to provide backup to a borrower who is taking out a loan.

Household Expenditure Measure. These are minimum living costs lenders use in the event your living costs are deemed low.

Interest Only. A repayment type where you do not need to repay principal. Repayments will vary due to the utilised balance, number of calendar days

Lenders Mortgage Insurance. A premium you pay to lend at higher loan to value ratios (usually 80% or more). This premium protects only the lender against loss, never the borrower.

Loan to value ratio. This is the loan amount divided by the property value. Always expressed as a percentage.

Reserve Bank of Australia. Our central bank sets interest rates which will impact mortgage lending rates.

This is a stress tested calculation of income v expenses that the lenders use to determine what level of debt you can borrow. It is different from actual figures, as a conservative view is applied on some income types and expenses are stressed. Each lender has its own method for calculating loan serviceability.

Electronic Docs & Signatures. Where E-docs / E-sign is used, turnaround times are generally shortened. Lenders are gradually favouring digital signatures.

Principal & Interest - this is the most common repayment type; it requires you to pay down your loan. Repayments are set based on the interest rate.

PEXA is an online property transaction system, adopted by lenders for purchases and refinances.

Verification of Identity (Sighting your ID). We must do this on behalf of the lender in accordance with their requirements. This is completed in person or remotely (via video). If you are purchasing, you may also need to do VOI with your conveyancer/solicitor as part of their requirements.