Often a misunderstood feature, mortgage offset accounts were first offered to manage tax, but extended to other mortgage products that were “packaged” with an offset capability. Today most basic/base variable products (without offset) now offer similar or lower interest rates.

Offset accounts offer the ability to isolate your savings from your loan, but whether it really works for you depends on your circumstances.

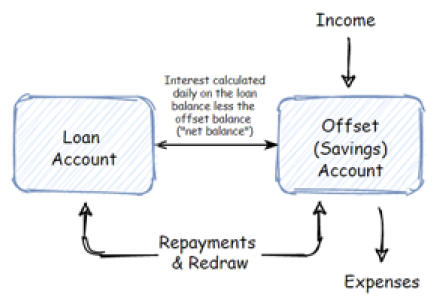

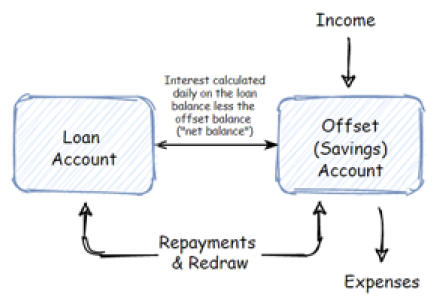

An offset account is linked to a loan, and the credit provider calculates the daily interest on the net balance (the loan balance less the offset balance). Sometimes offset accounts can add to the product cost so consider their real value.

For investors, should an amount you have previously repaid be “redrawn” you are effectively reborrowing it. From a tax perspective, the ATO Purpose Test may apply to whether funds are deductible. An offset account set up at the outset can avoid this.

Also rather than pay you interest on your savings; it is effectively deducting it off the loan interest - as you don’t earn interest you don’t pay tax on it.

An offset account may therefore work well for people building a property portfolio. Do you need an offset account? You should seek tax / financial advice if you are unsure.

The ATO has published a tax ruling on the topic of redraw and reborrowing of funds

1. The ATO states “ Where a loan facility allows for redraws of extra repayments, we consider those redraws constitute new borrowings of funds that cannot be traced to the extra repayments. In this regard the term 'redraw' is a misnomer. It is in effect a new borrowing of funds.”.

2. The ATO States “We consider a draw-down from a line of credit account or sub-account, or a redraw from a loan account, is a separate borrowing. Therefore, the deductibility of the interest on that separate borrowing ends on whether the interest is incurred in gaining or producing assessable income or is necessarily incurred in carrying on a business for the purpose of gaining or producing assessable income.